Guiding Principles

We believe in...

- Mitigating the tax burden on commercial property with specific policies to help incentivize necessary and/or desirable development.

- More efficiently allocating resources through partnership opportunities between economic development groups and avoiding duplication of efforts.

- Ensuring a properly skilled workforce and encouraging the retention of recent graduates through coordination of educational programs with private sector businesses.

- Investing in high quality infrastructure and beautification of priority corridors in order to enhance the livability for residents, boost the image of the City for visitors, and attract private investment.

- Following through with long-term, goal-based investments to ensure maximum results for public funding decisions over time.

ECONOMIC DEVELOPMENT ELEMENT DOCUMENTS

The economic development element is one of the nine elements of Columbia Compass: Envision 2036.

The economic development element is one of the nine elements of Columbia Compass: Envision 2036.

|

ECONOMIC DEVELOPMENT CHAPTER (PDF)

The economic development chapter includes a discussion of the above guiding principles; a brief synopsis of existing conditions; and a number of recommendations for the next ten years, as well as supporting case studies. |

|

APPENDIX C: ECONOMIC DEVELOPMENT EXISTING CONDITIONS REPORT (PDF)

The economic development appendix contains an in-depth analysis of existing conditions affecting economic development in Columbia and the Midlands. |

|

LEADING INDICATORS

Economic development policies and practices are geared towards business retention and expansion as well as the attraction of new businesses. There are a number of key indicators that market analysts, companies, and economic development professionals use to determine a community's strengths and weaknesses, including a community's capacity for talent and innovation, its gross domestic product and growth trends, and estimated operational and taxation/fee costs to businesses. |

What is Economic Development?"A program, group of policies, or activity that seeks to improve the economic well-being and quality of life for a community, by creating and/or retaining jobs that facilitate growth and provide a stable tax base."

-International Economic Development Council |

|

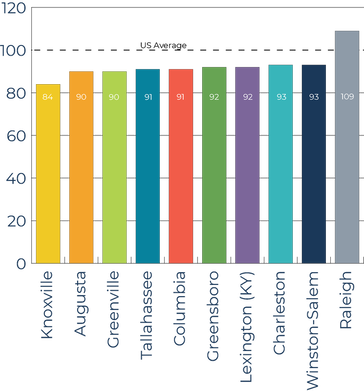

Talent Index Comparison (2017)

-Midlands Regional Competitiveness Report (2017)

|

TALENT

The talent indicator measures a region's ability to retain and attract the talent of a skilled workforce. Columbia is in line with our peer cities with regard to talent, however both Columbia and our peer cities are below the US average as calculated. The index value on talent in Columbia dropped five points from 2014 (96 points) to 2017 (91 points). |

GROSS DOMESTIC PRODUCT (GDP)

Gross domestic product is the total value of goods produced and services provided in the specified area during one year, and is one of the primary indicators used to gauge the health of an area's economy. Columbia's GDP is actually larger than Charleston's and closer to Greenville's, however Charleston has seen a larger regional growth rate than both cities from 2011-2016.

Gross domestic product is the total value of goods produced and services provided in the specified area during one year, and is one of the primary indicators used to gauge the health of an area's economy. Columbia's GDP is actually larger than Charleston's and closer to Greenville's, however Charleston has seen a larger regional growth rate than both cities from 2011-2016.

-US Bureau of Economic Analysis

|

-Midlands Regional Competitiveness Report (2017)

|

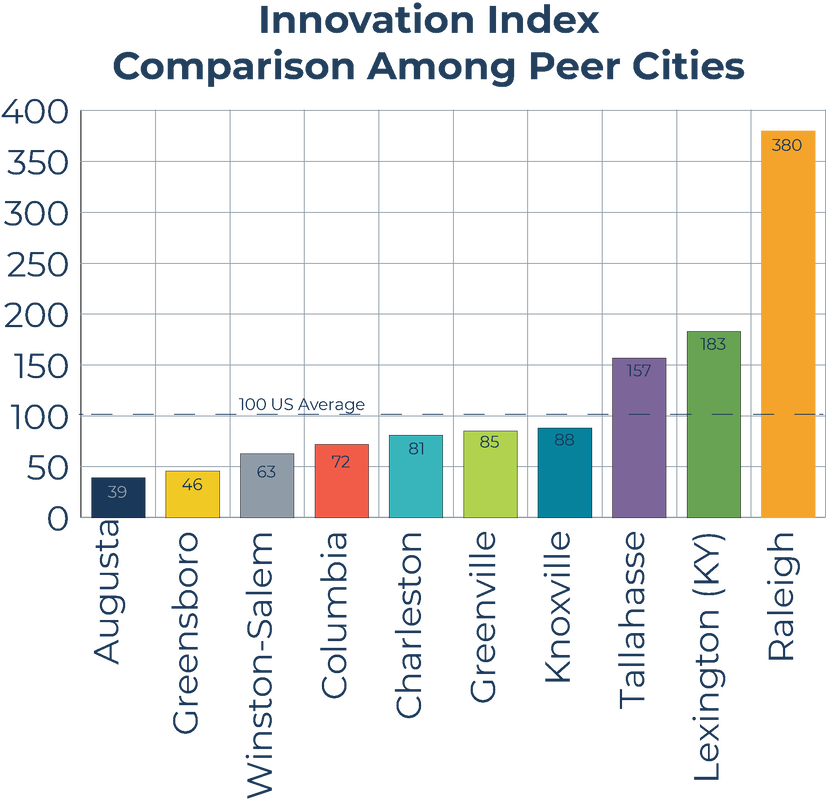

INNOVATION CAPACITY

According to the Midlands Regional Competitiveness Report (2017), innovation capacity is "a region's capacity to support the creation of new knowledge, to generate new ideas, products, and processes." Innovation capacity is measured as an index value, and indicators include innovation awards, intellectual property creation, research and development, academic achievement, and research and development funding. |

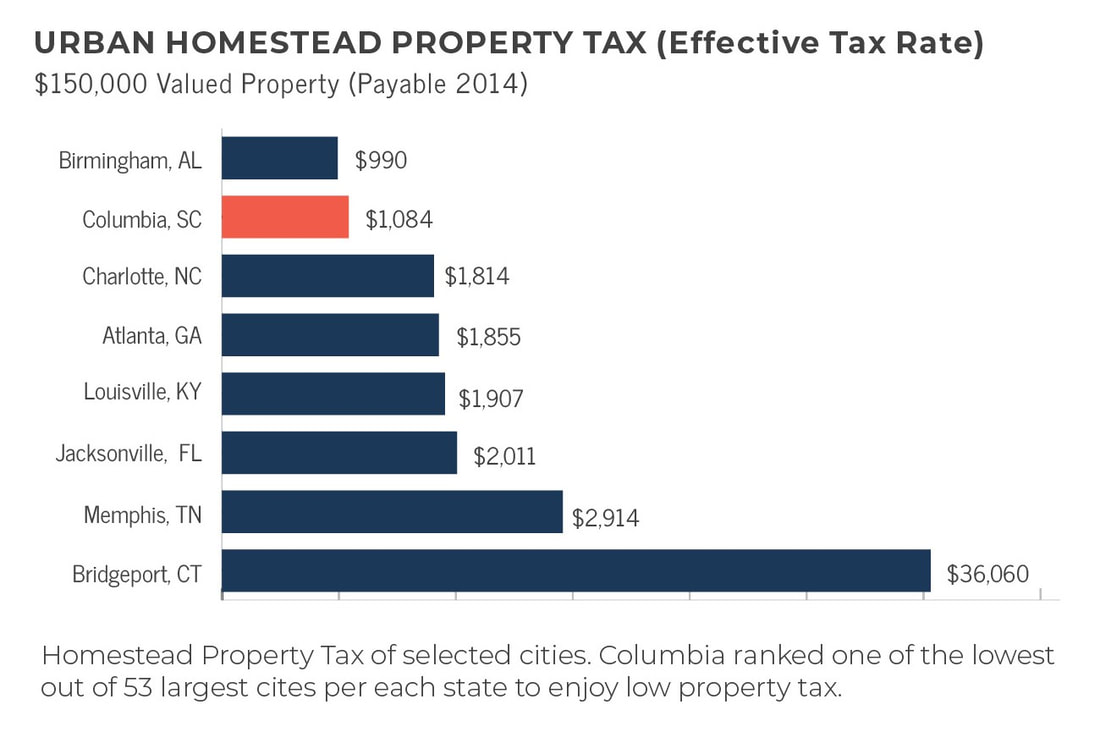

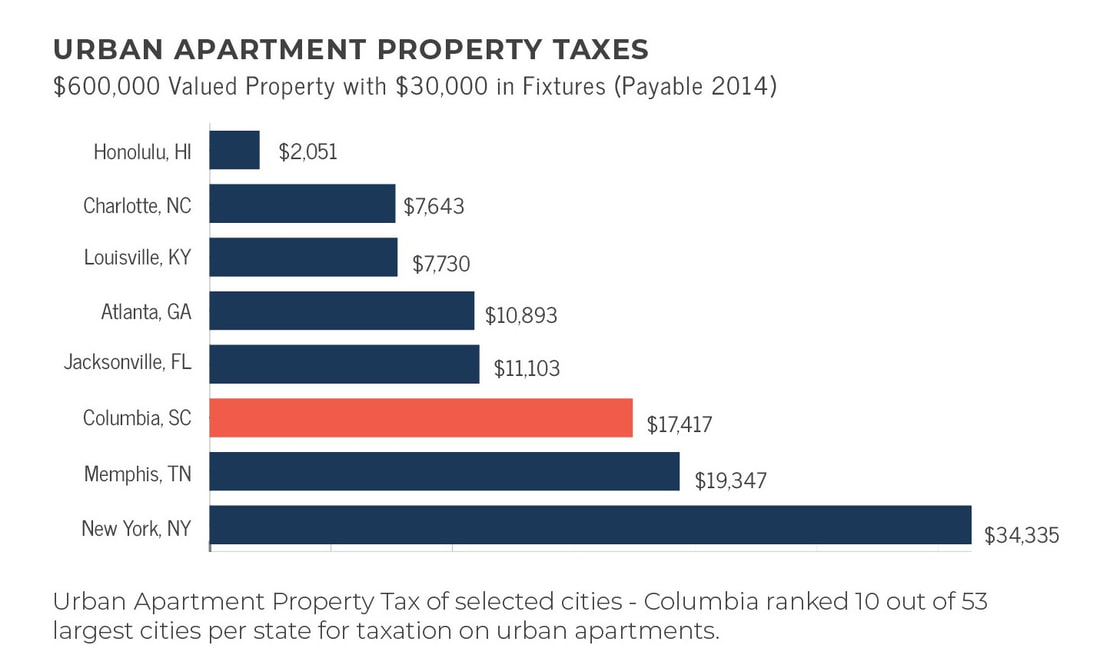

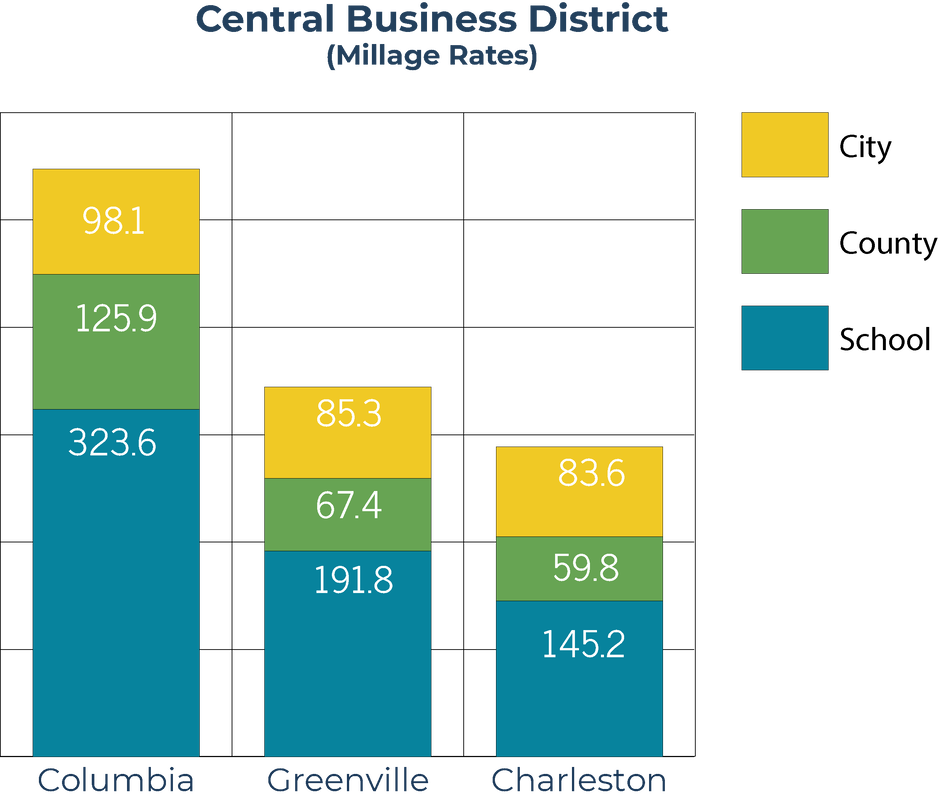

TAXES AND FEES

Taxes and fees have a significant influence on the success of a community, region, and state. Columbia is unique in that it has low residential taxation, high commercial and industrial taxation, and a large portion of the City's land area is non taxable. The below charts review the effective tax rates for homeowners, apartment owners, and property owners in the central business district, when compared with other communities.

Taxes and fees have a significant influence on the success of a community, region, and state. Columbia is unique in that it has low residential taxation, high commercial and industrial taxation, and a large portion of the City's land area is non taxable. The below charts review the effective tax rates for homeowners, apartment owners, and property owners in the central business district, when compared with other communities.